Fact Check Friday: SNAP vs Business

Kansas Legislature runs past waste in business world to shame low income families

I’ve written a number of times about how experience largely determines perspective, and perspective largely influences policy decisions in Topeka, and Washington, D.C.

For instance, if you are born into a wealthy family where you had more net worth the day you were born than most people in Kansas and feel safe in the knowledge that your family’s business will always keep you housed and fed - and then you find yourself at the head of a committee tasked with reforming the state’s welfare system - well, let’s just say your perspective likely isn’t that poor folks are trying their best to make it.

And if many of your co-workers view the world much the same way, when you start attacking those poor folks, you’ll find plenty of admiration for the “good work” you’re doing to reign in fraud and abuse.

Poor folks, it turns out, don’t have the money to buy themselves a bunch of lobbyists to fight for their cause. Sure, there are groups that are trying with all their might, but it’s hard to compete with Americans for Prosperity and the multitude of Corporate Dark Money groups who would snatch food from a child’s mouth if it meant they could escape paying income tax or get laws written to make that yacht or sports car a business expense.

The do-gooders for the Poor Folks’ lobby shows up to committees and tries to educate members, but that scarcely competes with maximum campaign contributions, lavish dinners, and all-the-booze-you-can-drink galas funded by the state’s wealthiest corporations and their army of paid advocates.

So it was little surprise to me this year that the Kansas Legislature gave Attorney General Kris Kobach greater power to investigate fraud in the state’s safety net system, at an anticipated cost of $1 million per year. And it was little surprise that the legislature seated a special committee to shame Gov. Laura Kelly’s administration for a higher than usual error rate in processing food assistance applications.

It’s a common practice - the Kansas Legislature will spend any amount of money to punish poor people, even when it harms the state’s budget to do so. A few years ago, while lawmakers gave away billions to a giant corporation, they refused to ease restrictions that would’ve made it easier for families with children to access assistance.

There was also another bill that added $3 million a year and projected the need to hire dozens more state employees - all to make it harder for people to access federally funded food assistance.

Every year, the Kansas Legislature attacks poor people, both through its hateful and ill-informed rhetoric and through policy, which makes it harder for people to get the help they need and makes it harder for staff to understand and execute the changes they must follow each and every year - likely leading to higher error rates.

Meanwhile, that same legislature lowered income taxes on upper incomes, created a path for corporations to escape income tax altogether, gave a 20-year comprehensive tax exemptions to Google, Amazon, Facebook, and X, and increased the amounts those corporations can make to political campaigns and PACS. (Remember, kids, it’s not cheating if you can change the laws to suit you!)

Oh, and they couldn’t deliver on those property tax cuts they promised during the campaign.

Let’s get back to that meeting about fraud in the social safety net system, and do a little math.

According to the reporting, there are 97,000 families who recieve SNAP (food assistance) benefits in Kansas, and the average was $392 per family. That’s $38 million dollars, all of which is federal money. Kansas pays for administering the program - which is why it costs us more when the legislature decides to restrict access.

That means at a 12 percent error rate, the state distributed $4.5 million in benefits that shouldn’t have gone to people. I’m not saying that’s nothing, but in a $25 billion budget, that’s a drop in the bucket.

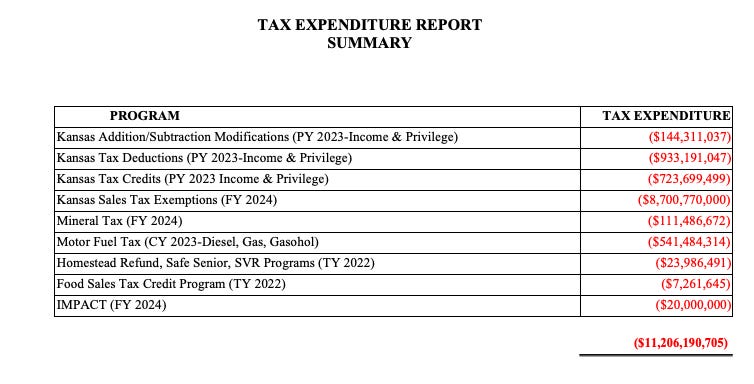

But over on the tax exemption side, there are more than $11 billion in tax expenditures - some doled out to people, but a good chunk used to help various businesses and industries.

You get the picture. If you want to do more research on your own, here’s the most recent report.

For comparison, the state in 2022 only gave out $13.9 million for Homestead Rebate refunds, which offset property taxes for low income households. The average rebate was $234 and the average income was a paltry $20,981. That program could and should be expanded before giving away another cent to corporations.

Keep in mind that doesn’t include all the various other incentives that are out there from different levels of government. Modern business builds taxpayer giveaways into their business models. They’ve shaped an environment in which we’re all so desperate for whatever crumbs we can get, we’ll give away the farm to get a little bit of food.

When it comes to business, we’ll gladly do it and call it an investment and find creative new ways to give away the taxes you pay to the state. When it comes to people, the state’s leaders assume malice and find creative new ways to make life harder for people who’s lives already are quite difficult.

For the record, no one wants to be poor. It’s not a thing any of us ever aspires to be. No child, ever, has envisioned that future for themselves. Often, it’s something we’re born into, something our parents lived in, and what our grandparents lived in, too. Sometimes, circumstances beyond our control - health issues, accidents, job losses, etc. - set us on a path that is hard to overcome, particularly in an economy that traded the concepts shared investment and opportunity the accumulation of wealth at any cost.

If it’s waste we’re looking for, I’d suggest the legislature turn its sights on the billions it gives away every year in tax credits, exemptions, and benefits to corporations that, based on their annual reports and executive salaries, seem to be doing just pretty OK.

And if it’s abuse of entitlement we hope to root out, well, I might suggest a different group of people to examine altogether.

Hey one item I might point out (I apologize for not sharing via private message) that I believe is inaccurate is total amount of SNAP dollars allocated to Kansas households. In the article you refenced the Kansas Reflector article, I believe, that there are roughly 97,000 families. However, according to DCF's own numbers, it's really closer to 190,000.

In addition, it is $400million a year in SNAP dollars allocated to Kansas households, which means there is just north of $40million over the last several years in overpayments.

The shame in this number is that DCF then goes back and makes the beneficiary household repay DCF's own error in either a reduction in SNAP benefits until DCF is made whole or requiring them to actually give money back to DCF.

I think you can see why this specific problem is so egregious.

Here is a link from DCF's own website: https://www.dcf.ks.gov/services/ees/Documents/Reports/PAR_SFY2025.pdf

Hope this helps.

BTW, I really enjoy reading your substack, you have some great content, even if I don't always see eye-to-eye!