Fact Check Friday - Kansas has been duped

Kansas Legislature just passed a sneaky flat tax while largely ignoring property taxes

At some point, we have to start connecting the very obvious dots that are right under our noses. Because we’re being lied to, duped, and manipulated in some very dangerous ways.

During the last election Republicans built much of their campaigns around property taxes and people being priced out of their homes. Elect them, they said, and property tax relief would be their first and most important priority.

But that was the campaign trail, not the actual work of governing - and that’s where groups like the Kansas Chamber of Commerce expect to cash in the favors for all that money they invested in their loyal, unquestioning, servants in the Kansas Legislature.

What did they get for that money? A reneging on meaningful property taxes relief in exchange for a sneaky and sinister version of a flat tax that will reduce the tax rate paid by the state’s biggest corporations and banks.

Two key tax bills are headed to Governor Kelly.

Senate Bill 35 is a property tax bill. It removes the state’s 1.0 mill levy for state educational buildings, as well as the .5 mill for state institutions buildings. These help offset the cost of building projects for public schools and universities. The money lost from this mill levy reduction - $81 million in the first year - will come from the state general fund.

Senate Bill 269 is a gut-and-go of an original bill about tax appeals that became a complex ratcheting down of income tax rates - in effect creating a pathway to a flat individual income tax but ultimately a superhighway to eliminating the corporate tax rate in Kansas.

While we’re talking taxes, and the cuts you didn’t get, I want to put a pin in these changes to campaign finance laws that will enrich politicians, and give special interests more control over the legislature. I’ll show you in a minute how taxes and campaign law are connected.

So let’s start connecting some dots.

SB35 does nothing significant for the average Kansas homeowner. If you own a $500,000 home, you’ll enjoy a whopping $86.25 in property tax reduction.

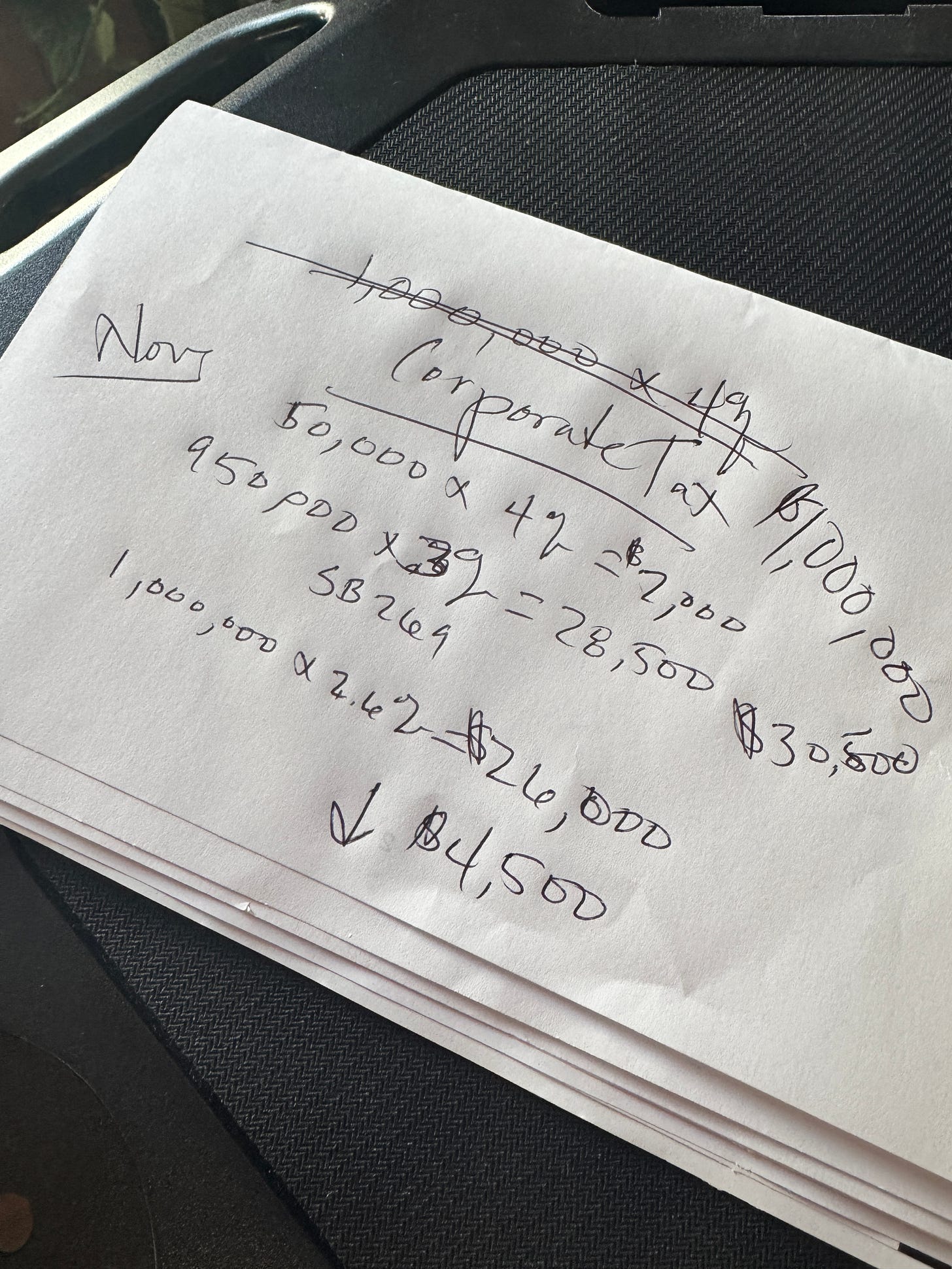

Here’s the math…

The average home price in Kansas is $262,500, meaning the average savings in Kansas will be $45.29

But the average home in Hutchinson isn’t anywhere near that. In my part of town, it’s closer to $100,000 or so, with many below that level. That means the average person in the 102nd is likely to save a whopping $17.25.

You can’t even order a mediocre dinner from a chain restaurant for that.

Now let’s draw a line over to income tax - which is always a much bigger interest for the state’s wealthiest corporations.

Groups like the Kansas Chamber of Commerce have been obsessed for years with creating triggers in tax policy. In SB269, they established such a trigger tied to the state’s tax collections and something called the Budget Stabilization Fund.

Basically, if tax receipts at the end of each fiscal year exceed receipts from the previous year, and if the Budget Stabilization Fund exceeds 15 percent of the prior year’s state general fund tax revenues - it triggers a reduction in the state income tax rate.

The bill starts by lowering the state’s two tax rates - 5.2 percent and 5.8 percent for upper incomes - to 4 percent.

A flat tax, where the person who makes $25,000 a year and the person who makes $1,000,000 a year pay the same tax rate - and that’s not including the fact that the person with $1M in earning will definitely pay to find some nice tax loopholes to effectively lower that rate.

But here’s the real meat of this triggered tax response from the state’s richest corporations - once there’s a single rate of 4 percent for individuals, the tax rates for corporations and banks will start to fall - to a bottom of 2.6 percent. Considerably lower than what working Kansans will pay.

The bill is so bad, so wrought with issues, not a single Republican in the House debate even attempted to defend the bill.

Let that sink in. They sat on their hands and voted for it, without comment - likely because their leadership instructed them to do this.

What’s the fiscal effect of this bill? What will it mean for Kansas? We don’t know because it’s impossible to predict. Here’s the note from legislative research…

“According to the fiscal note prepared by the Division of the Budget…the Department of Revenue indicated enactment of the bill is not likely to trigger a rate reduction in 2025, but could reduce SGF receipts by unknown amounts in future years.”

But here’s some overly simple math to illustrate the point. Remember that corporations will have teams of people to make their effective tax rate much lower, or even zero under current law. And out-of-state corporations have different formulas.

The immediate effect, as my friend Chris Courtwright points out from his years as the state’s chief economist, is that giving all this unknown amount of money away to the state’s richest corporations actually undermines our future ability to provide meaningful tax relief to Kansans. It also undermines the state’s ability to adequately fund what matters to us - like education and infrastructure - and hamstrings our ability to respond to future crisis, or opportunities.

In effect, the Kansas legislature, comprised of all those people who said they’d lower your property tax and hawkishly balance government budgets - has voted to give all of your future tax savings away to their corporate campaign donors - who will now have an easier time keeping their “friends” in office.

Another good point raised by Courtwright is that the bill creates opportunities for wealthy corporations to manipulate the final fiscal year tax numbers with “anticipated” tax payments over the summer that may or may not materialize.

“Given that a small percentage of Kansas corporate filers pay most of the liability, let’s envision one of these heavy-hitting corporations rushing in during late June some year and insisting on making an unexpectedly large “estimated” payment for which they can always end up being reimbursed the next time they file. Because revenue estimators in April would not have known this eleventh-hour stratagem would transpire, that large (and maybe temporary) payment could boost June 30 receipts above the final forecast, triggering future rate cuts for that corporation, as well as their corporate brethren and individuals. I remain mystified why we should authorize this while cheering on the “simplicity” of the legislation.”

And let’s be clear - that 2.6 percent rate isn’t the end, it’s the start.

The goal of the Corporatist Elite has always been to escape paying taxes altogether. And they have proven time and again that they don’t care what the effect will be on infrastructure, society, or on families. In their world, we all should be grateful for the jobs they offer that don’t pay enough to get by in today’s world. In the struggle between a representative government and growing corporate greed, they actively work towards a world in which government is so weakened and damaged, each of us is subjugated to wealthy corporations.

Their lot might be evil, but they’re not stupid. So here’s what I expect the next parts of their plan to be. Once the corporate rate falls to 2.6 percent, some conversations about lowering the individual tax rates will start, but likely will include triggers for further reductions in the corporate and bank tax rates.

Before I connect this last dot, let’s recap…

Republicans campaigned on the promise to lower property taxes rates if you voted for them.

Kansas did vote for them, and they won bigger super majorities in the House and Senate - enough to pass any legislation they can imagine and override any veto.

Once they got to Topeka, they passed meaningless property tax relief that will save the average Kansan less than $50/year.

They passed an income tax reduction for corporations and banks without even putting up a whimper of a fight - presumably due to leadership demands.

The income tax triggers can and likely will be manipulated by the state’s largest corporations - using sleight of hand accounting to force reductions

There will be less revenue for property tax relief in future years due to corporate tax reductions.

There will be less revenue to fund the state’s needs, like education, infrastructure, business development and recruitment.

The Kansas Legislature will continue to strangle our communities by pushing the cost of government down to the local level, which is a primary driver of local tax increases.

Given historical norms and tendencies, groups like the Kansas Chamber of Commerce will continue to push for a 0 percent tax rate for the state’s wealthiest corporations.

I know this is long, but stay with me. There’s one more dot that we have to connect.

While you’re not getting any tax relief, while we’re again walking toward the familiar cliff to zero corporate taxes - the Kansas Legislature also passed legislation to enrich its own campaign coffers, give more electoral control to legislative leadership, and made it legal for corporations and special interests to give unlimited money to the loyal candidates and legislators.

Now, it seems, we’re starting to get a better picture of why these groups invested so much money in the 2024 election. It wasn’t just an investment in one election cycle - it was an investment in the long term future, in securing a legislature that would change tax policy and campaign finance laws in ways that would pay off for decades to come.

I wrote extensively about what’s been dubbed “The Incumbent Protection Act” - a two bill package that will open the floodgates to corporate money and change the laws around coordinating with candidates.

From my previous column…

“HB2206, which passed the House and is now in the Senate, would change language around “cooperation and consent,” which loosens current restrictions and prohibitions on the coordination between candidates, PACs and other groups. It also raises the limit on anonymous donations form $10 to $50, and makes changes to reporting requirements and makes changes to the definitions around “giving in the name of another” - what’s commonly known as a Straw Man donor.”

“This bill (HB2054) doubles the amount candidates and officeholders can receive from individuals, lobbyists, corporations, and PACs. For the House of Representatives the max contribution goes from $500 to $1,000, while for Senators it goes from $1,000 to $2,000. It also increases cash donations from $100 to $200. Another worrisome element, however, is the removal of annual limits on contributions to political party committees by people, national party committees, and political committees, or PACs. Remember that we now consider corporations to be people and money to be free speech.”

So, here are the last dots to connect.

Corporations successfully alter campaign laws, gut ethics commission, increase exponentially the money in politics, and eliminate barriers to special interests coordinating with campaigns and candidates.

Corporations now legally can work with legislative leadership to more tightly control behavior and votes of members of the House and Senate through threats of funding election challengers. This will be used by both Republicans and Democrats (and there’s rumbling that the governor will sign this bill). As we saw on this flat tax, not a single Republican in the House has the nerve to challenge or criticize the bill. Likewise, people now what can happen if a candidates gets crosswise of the powers that be in the Democrat party.

Emergent candidates challenging incumbents will likely be cut off from campaign contributions from political parties, leadership PACs, and special interests - all of which typically favor known incumbents.

Corporations and special interests can likewise compel favorable behavior from lawmakers through the threat of withholding funding or by funding a more favored challenger.

There it is.

One of my most valued Republican mentors in the Kansas Legislature told me that “the issue is never the issue.” That has been proven true to me time and time again.

The issue never was fighting inflation.

The issue never was providing you with real property tax relief.

The issue never was a fear of “woke” ideology.

The issue was the exact same issue that it’s always been - Greed, Power, and Control.

There was a plan to dupe Kansans, and it worked perfectly.

They elected the legislature they want to get the policies they want without resistance.

They have the tax policy they want to increase their wealth and power in the state.

They have the election laws they want to hold power and control over lawmakers.

P.S. It seems like a good time to point out that in the 2020-2022 I worked with a group of people to develop real property relief for Kansans. It met firm resistance - largely because groups like the Kansas Chamber want their income tax cuts.

But for roughly $300 million we would’ve provided up to a $1,500 rebate for nearly 400,000 Kansans over the age of 55 with incomes under $75,000 to offset their property tax bill. Under this plan, for less than the untold amounts Kansas taxpayers will spend on cutting taxes for the richest corporations, we could’ve provided real tax relief to people struggling to pay their bills.

You should ask you lawmaker why they voted for income taxes for corporations instead of developing a real plan to offset rising property taxes. They are showing all of us what they really care about. It’s time we start believing them.