Fact Check Friday - Kansas has been duped 2

Legislative Supermajority drops ball on real property tax relief - but nearly passes exemption on toys for the wealthy

I’ve written before about how much of what happens in the legislature - the bills that pass and the conversations that drive policy - are often a matter of perspective.

For instance, the already wealthy lobbyists who come from already wealthy families who are more than happy to take money from out-of-state groups who want to make life harder for poor people have never shared my perspective of being a very young and poor parent, earning less than $1,000 a month, trying to figure out how to provide for a newborn child.

Their perspective, it seems, is that every person who wasn’t born as blessed as them is some sort of freeloader who should be scrutinized and investigated.

My perspective is that people who relish in making life harder on poor people are bottom feeders who justify anything for the almighty dollar, while doing the mental gymnastics necessary to continue presenting themselves to the world as good charitable Christians.

Christ, by the way, would’ve fed the poor without qualification or derision.

While some of these people were out kicking poor folks in the ribs, they also were not following through on their campaign promises to provide meaningful property tax relief for Kansas homeowners.

However, it seems they had plenty of time to talk about creating a flat tax that largely benefits wealthy earners, and a ratcheting down of the corporate tax rate to a lower rate than you and your family will pay - in an effort to realize former Governor Sam Brownback’s fever dream of a Kansas where no business ever pays a dime of income tax. (It’s worth noting that one of the lobbyists for Opportunity Solutions Projects - the most vocal group eroding social support programs, was formerly a staffer with Brownback).

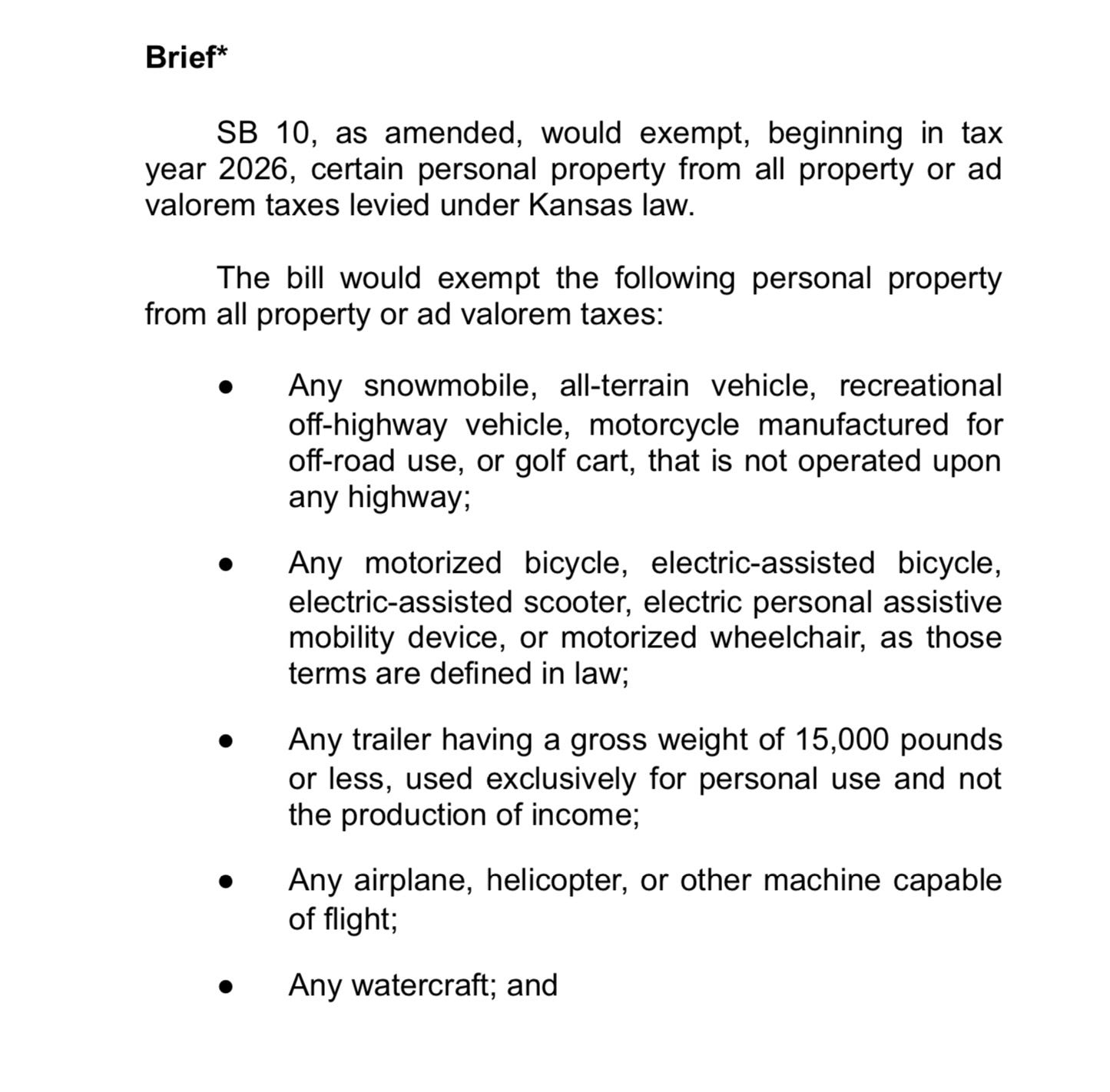

While the Kansas Republican Supermajority could only find less than $50 in annual savings for most homeowners while lowering corporate income taxes, they also had a very robust conversation about how to create a property tax exemption for playthings - including off-road vehicles, recreational vehicles, golf carts, boats - and airplanes and helicopters.

That’s right. Airplanes and helicopters.

The bill passed out of the Senate on a 37-3 vote support - likely widely supported out of fear that the election season postcards would say lawmakers voted against property tax relief, while leaving out all of the pertinent details.

The House tax committee approved the bill and it’s waiting for a full vote in the House. I would watch this one to see if it’s bundled into a last minute, late-night tax package that’s sent to the governor.

The fiscal note on the tax exemption isn’t overwhelming - and a good number of working people own boats, recreational vehicles, and off-road vehicles. Airplanes and helicopters, not so much. So I can see some merit to parts of this policy.

But I think in this discussion on policy is less important that the discussion on perspective - and how the perspective of the people we sent to Topeka informs, influences, and prioritizes policy.

The perspective of the public is largely that our political and economic systems are not working for most of us. That everything is more expensive. That our lives have largely been reduced to a a resource from which giant corporations mine their wealth. And if our wellbeing threatens or stands in the way of their ever-growing profit, they will use their resources - gained from our labor and creativity - to shape policy to make us compliant and make it easier for them to extract more wealth from out lives.

The public has said it wants and needs meaningful property tax relief. But the perspective of the people who hold the levers of power in Topeka - and in Washington, D.C. - care much more about income tax relief and escaping taxes on their playthings they like to buy with that money.

Kansans voted for people on the claim that if these Republicans won election, property tax relief would be the top priority. They won - and have enough members to do anything they damn well please - but they prioritized everything except property tax relief. I suspect, in part, so it can stay alive as a lively campaign issue in 2026.

If lawmakers and the lobbyists who whisper in their ears shared your perspective this Republican Supermajority would’ve assembled its members and pushed through a substantive plan to reduce or offset rising property taxes. Leadership has to the weapons to keep their members complaint and even silent in the face of bad legislation.

If lawmakers and the lobbyists who make money from the misery of the impoverished shared your perspective, they’d have spent less time finding ways to grow their power, and more ways to help empower the people of Kansas.

If lawmakers in Topeka shared your experience, they would see the hypocrisy of increasing the campaign contribution amounts they can receive from lobbyists, corporations, and special interest groups by more than 10 times the amount you’ll save on property taxes in the next year.

Perspective matters, and we really get a sense of our lawmakers’s perspective in the policies they advance and support in the legislature - not in the glossy campaign postcards that are paid for by their corporate backers.

If we keep electing people to positions of power who don’t share our perspective, our experiences, we will continue to get policy that doesn’t reflect our priorities or our concerns.

And we’ll continue to elect people who will prioritize income, playthings, and power games, over meaningful policy that moves our state forward.

Personal property tax on vehicles that are 10 years old or older should be dropped. Property tax on “toys” and vehicles that are less than 10 years old should have tax collected on them.